Calculate Ear With Continuous Compounding on Financial Calculator

What is Continuous Compounding?

Continuous Compounding calculates the Limit at which the Compounded interest can reach by constantly compounding for an indefinite period, thereby increasing the Interest Component and ultimately the portfolio value of the Total Investments.

Table of contents

- What is Continuous Compounding?

- Continuous Compounding Formula

- Example

- Uses

- Continuous Compounding Calculator

- Continuous Compounding Formula in Excel (with excel template)

- Recommended Articles:

Continuous Compounding Formula

Continuous Compounding Formula = P * erf

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Continuous Compounding Formula (wallstreetmojo.com)

The continuous compounding formula Compounding is a method of investing in which the income generated by an investment is reinvested, and the new principal amount is increased by the amount of income reinvested. Depending on the time period of deposit, interest is added to the principal amount. read more determines the interest earned, which is repeatedly compounded for an infinite period.

where,

- P = Principal amount (Present Value)

- t = Time

- r = Interest Rate

The calculation assumes constant compounding over an infinite number of periods. Since the period is infinite, the exponent helps in the multiplication of the current investment. This is multiplied by the current rate and time. Despite many investments, the difference in total interest earned through continuous compounding excel is less than traditional compounding, which will be examined through examples.

Example

Let us analyze some of the instances:

You can download this Continuous Compounding Excel Template here – Continuous Compounding Excel Template

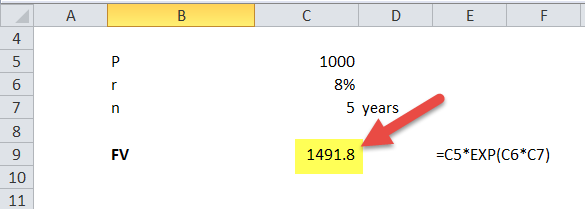

If an initial investment of $1,000 is invested at 8% interest per year with continuous compounding, how much would be in the account after five years?

- P = $1,000, r= 8%, n= 5 years

- FV = P * e rt = 1,000 * e (0.08) (5)= 1,000 * e (0.40) [Exponent of 0.4 is 1.491] = 1,000 * 1.491

- = $1,491.8

Let us calculate the effects of the same on regular compounding:

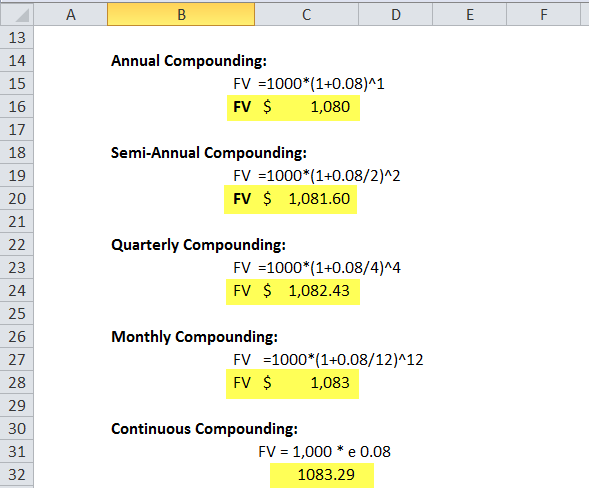

Annual Compounding:

- FV = 1,000 * (1 + 0.08) ^ 1 = $1,080

Semi-Annual Compounding:

- FV = 1,000 * [(1 + 0.08/2)] ^ 2

- = 1,000 * (1.04) ^ 2

- = 1,000 * 1.0816 = $1,081.60

Quarterly Compounding:

- FV = 1,000 * [(1 + 0.08/4)] ^ 4

- = 1,000 * (1.02) ^ 4

- = 1,000 * 1.08243

- = $1,082.43

Monthly Compounding:

- FV = 1,000 * [(1 + 0.08/12)] ^ 12

- = 1,000 * (1.006) ^ 4

- = 1,000 * 1.083

- = $1,083

Continuous Compounding:

- FV = 1,000 * e 0.08

- = 1,000 * 1.08328

- = $1,083.29

As can be observed from the above example, the interest earned from continuous compounding is $83.28, which is only $0.28 more than monthly compounding.

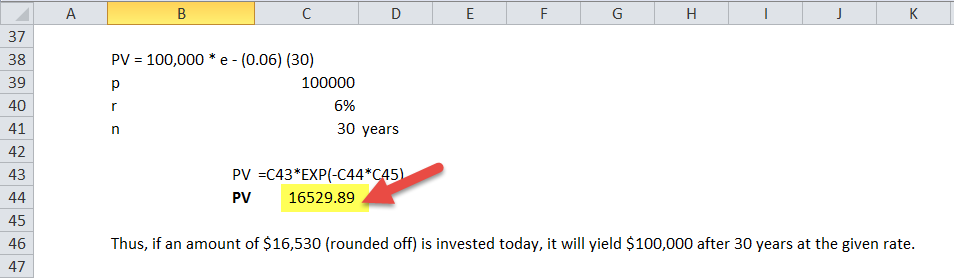

Another example can say a Savings Account pays 6% annual interest, compounded continuously. How much must be invested to have $100,000 in the account 30 years from now?

- FV = PV * ert

- PV = FV * e – rt

- PV = 100,000 * e – (0.06) (30)

- PV = 100,000 * e – (1.80)

- PV = 100,000 * 0.1652988

- PV = $16,529.89

Thus, if an amount of $16,530 (rounded off) is invested today, it will yield $100,000 after 30 years at the given rate.

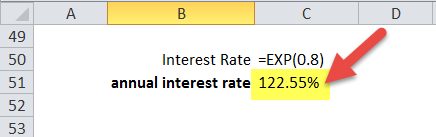

Another instance can be if a loan shark A loan shark offers easy credit to borrowers at unreasonably high interest rates. Such lenders usually trap destitute borrowers who are desperate for immediate cash. They make profits out of exorbitant rates and unethical vehicles of debt recovery. read more charges 80% interest, compounded continuously, what will be the effective annual interest rate?

- Interest rate = e 0.80 – 1

- = 2.2255 – 1 = 1.22.55 = 122.55%

Uses

- Rather than continuously compounding of interest on a monthly Monthly compound interest refers to the compounding of interest every month, which implies that the compounding interest is charged both on the principal and the accumulated interest. read more , quarterly, or annual, this will effectively reinvest gains perpetually.

- The effect allows interest amount to be reinvested, thereby allowing an investor to earn exponentially.

- This determines that it is not only the principal amount that will earn money, but the continuous compounding of interest amount will also keep on multiplying.

Continuous Compounding Calculator

You can use the following Calculator

| P | |

| r | |

| t | |

| Continuous Compounding Formula = | |

| Continuous Compounding Formula = | P x e(r x t) = | |

| 0 * e(0 * 0) = | 0 |

Continuous Compounding Formula in Excel (with excel template)

This is very simple. You need to provide the Principle Amount, Time, and Interest rate inputs.

You can easily calculate the ratio in the template provided.

Example – 1

You can easily calculate the ratio in the template provided.

Let us calculate the effects of the same on regular compounding:

As can be observed from the continuous compounding example Compounding is a method of investing in which the income generated by an investment is reinvested, and the new principal amount is increased by the amount of income reinvested. Depending on the time period of deposit, interest is added to the principal amount. read more , the interest earned from this compounding is $83.28, which is only $0.28 more than monthly compounding.

Example – 2

Example – 3

Recommended Articles:

This has guided the Continuous Compounding formula, its uses, and practical examples. Here we also provide you with Continuous Compounding Calculator with a downloadable excel template. You can refer to the following articles as well –

- Compounding Quarterly Formula The compounding quarterly formula depicts the total interest an investor can earn on investment or financial product if the interest is payable quarterly and reinvested in the scheme. It considers the principal amount, quarterly compounded rate of interest and the number of periods for computation. read more

- Matrix Multiplication in Excel The MMULT function in Excel is an inbuilt function for matrix multiplication. It accepts two arrays as arguments and returns the product of the two arrays. read more

- Compound Journal Entry Definition The Compound Journal Entry is simply a combination of several simple journal entries, each of which includes one or more debit, credit, or both entries. Furthermore, it affects at least three accounting heads. read more

- Calculate Simple Interest Formula Simple Interest (SI) is a way of calculating the amount of interest that is to be paid on the principal and is calculated by multiplying the principal amount with the rate of interest and the number of periods for which the interest has to be paid. read more

Source: https://www.wallstreetmojo.com/continuous-compounding-formula/

0 Response to "Calculate Ear With Continuous Compounding on Financial Calculator"

Enregistrer un commentaire